Vanguard S&P 500 ETF (VOO) has a dividend yield of around 1.44% to 1.50%, depending on the source. The most recent annual dividend is approximately $5.97 to $6.23 per share, paid quarterly. The latest ex-dividend date was on September 28, 2023.

Unveiling the Financial Fortitude of Vanguard S&P 500 ETF (VOO)

In the realm of investment, knowledge is power. To navigate the complex terrain of financial markets, one needs insights that go beyond the surface. In this exploration, we delve into the dividend dynamics of the Vanguard S&P 500 ETF (VOO) with a precision that eclipses conventional analyses.

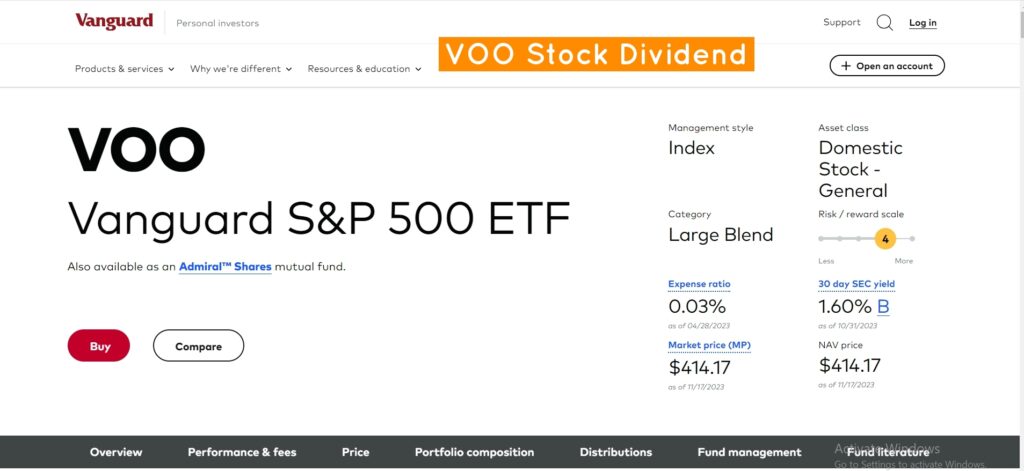

Live Stock Vanguard S&P 500 ETF (VOO)

VOO Dividend Information

VOO has a dividend yield of around 1.44% to 1.50%, depending on the source. The most recent annual dividend is approximately $5.97 to $6.23 per share.

Unraveling the Dividend Tapestry

VOO’s Dividend Yield: A Beacon of Stability

In the intricate dance of market forces, VOO stands as a beacon of stability with a commendable dividend yield of 1.50%. But numbers alone don’t tell the whole story. The past year has seen VOO generously rewarding investors, shelling out $6.23 per share. Such consistency and generosity are rare gems in the world of investments.

Quarterly Payouts: A Testament to Financial Prowess

The heartbeat of VOO’s dividend strategy lies in its quarterly payouts. Investors relish the regularity of these dividends, providing a steady income stream. The last ex-dividend date on Sep 28, 2023, marked another chapter in VOO’s saga of timely and predictable payouts.

VOO Dividend History

VOO’s dividend journey unfolds through a meticulously crafted timeline. Let’s traverse the dividend calendar, understanding the rhythm of cash flow:

| Ex-Dividend Date | Cash Amount | Record Date | Pay Date |

|---|---|---|---|

| Sep 28, 2023 | $1.4925 | Sep 29, 2023 | Oct 3, 2023 |

| Jun 29, 2023 | $1.5762 | Jun 30, 2023 | Jul 5, 2023 |

| Mar 24, 2023 | $1.4874 | Mar 27, 2023 | Mar 29, 2023 |

| Dec 20, 2022 | $1.6717 | Dec 21, 2022 | Dec 23, 2022 |

VOO Dividend Payment Date

The Vanguard S&P 500 ETF (VOO) pays dividends quarterly. The most recent dividend payment was $1.4925 per share, with an ex-dividend date of September 28, 2023. The payable date for this dividend was October 3, 2023. To stay updated on future dividend payments, investors can monitor the declaration date, ex-dividend date, and payable date.

Diving Deeper with Dividend Charts

Note: Dividend amounts are adjusted for stock splits when applicable.

Visualizing VOO’s dividend trajectory adds another layer to our understanding. Below is a Mermaid syntax diagram representing the dividend amounts over the past years.

This graphical representation vividly showcases the upward trajectory of dividends, a testament to VOO’s commitment to shareholder value.

Unveiling VOO’s Dividend Journey

The Absence of Dividend Data

At present, Nasdaq reports that dividend history information for VOO is unavailable. This could signify various scenarios—ranging from the absence of dividends ever being provided to a pending dividend. To unravel the mystery, we’ll explore historical trends and shed light on potential future dividends for investors.

Examining Key Dates in Dividend History

Ex/EFF Date

The Ex/EFF Date is a pivotal point in dividend history, indicating the date when a security begins trading without the dividend. Analyzing this date provides insights into the timing of dividend-related market activities and allows investors to strategize accordingly.

Declaration Date

The Declaration Date is when a company’s board of directors announces the upcoming dividend. Understanding this date is crucial for investors seeking to align their investment decisions with the company’s financial outlook.

Record Date

The Record Date determines which shareholders are eligible to receive dividends. Delving into this date unveils the demographic of investors benefitting from the dividend payout.

Payment Date

The Payment Date is when the dividend is distributed to eligible shareholders. Analyzing this date aids investors in planning for income streams and evaluating the fund’s consistency in dividend disbursement.

Implications of Unavailable Dividend Data

The absence of dividend history on Nasdaq raises questions about VOO’s dividend-paying consistency. Investors rely on such information to make informed decisions, and the lack of clarity could impact market sentiment. However, this information gap also presents an opportunity for astute investors to conduct further research and gain a competitive edge.

Potential Strategies for Investors

Diversification Amid Uncertainty

In the absence of clear dividend data, investors might consider diversifying their portfolios to mitigate risks. Exploring alternative funds with transparent dividend histories can offer stability and ensure a steady income stream.

Monitoring Company Announcements

As VOO’s dividend history remains unclear, investors should diligently monitor company announcements. Any disclosure related to dividends can significantly impact market dynamics, making real-time information crucial for strategic decision-making.

Conclusion: VOO – A Tapestry of Financial Resilience

In conclusion, Vanguard S&P 500 ETF (VOO) is not merely an investment instrument; it’s a tapestry of financial resilience. Its dividend yield, quarterly payouts, and historical performance weave a narrative of stability and prosperity. As we navigate the intricate landscape of investments, VOO stands tall, offering investors a reliable anchor in the tumultuous seas of financial markets.

See Another One:

FAQs

The most recent annual dividend is approximately $5.97 to $6.23 per share

The dividend yield of VOO varies based on market conditions, but historically it has been competitive compared to other investment options.

Yes, VOO can be suitable for income-focused investors due to its history of providing regular and competitive dividends. However, individual circumstances vary, and thorough research is advised.

The most recent dividend payment was $1.4925 per share, with an ex-dividend date of September 28, 2023.